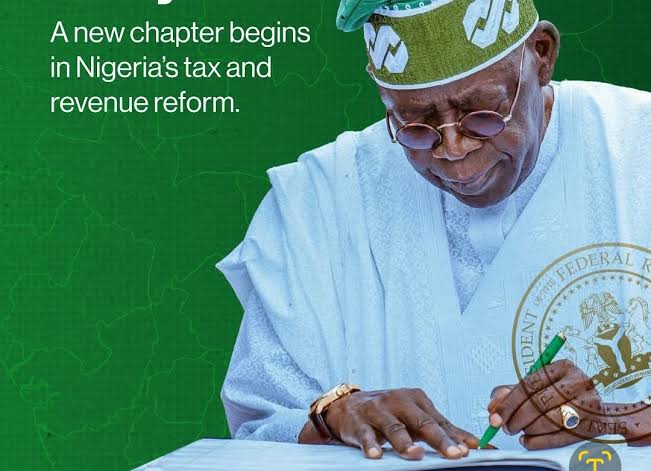

President Bola Tinubu signed four new tax reform bills into law, marking a pivotal moment for Nigeria’s fiscal landscape. The bills are designed to modernize the country’s tax system, reduce duplication, and create a more business‑friendly environment while boosting government revenue. The new measures will unify tax policies across federal, state, and local levels, making the system more efficient, transparent, and predictable.

With the reforms, Nigeria will establish a new tax administration body that replaces the Federal Inland Revenue Service, providing a more autonomous and results‑driven structure for collecting both tax and non‑tax revenues. A joint revenue board will also be set up to foster collaboration across all levels of government, making enforcement seamless and resolving long‑standing tax disputes more effectively.

These changes are part of President Tinubu’s “Renewed Hope” agenda, aimed at strengthening Nigeria’s economic foundation. By simplifying compliance and creating a stable tax environment, the new laws are expected to benefit businesses and attract both local and foreign investment. The administration believes this overhaul will enable the country to mobilize more resources, reduce waste, and build a stronger, more resilient economy for its people.